Affiliate marketing has emerged as an integral part in the modern economy providing business and individuals a flexibility to earn passive income from promoting the products or services. In the multitude of niches that are available that are available, the financial sector, especially the business credit card affiliate programs is being among those that are the most lucrative. With the highest commissions, recurring revenue possibilities and a rising market for corporate credit cards, this area offers a huge chance for marketers who affiliate to grow their business in 2025. This guide of 2,000 words provides an overview of the business credit program affiliates, highlighting the most effective options, strategies to succeed, and the most important aspects to help you increase your profits.

What Are Business Credit Card Affiliate Programs?

Affiliate programs for business credit cards are agreements with financial establishments (such like banks and credit card issuers) along with affiliate marketers. These programs permit marketers to receive commissions from providing entrepreneurs, business owners, and small-business specialists to request certain corporate credit card. If a person who is referred to decides to apply and is accepted for an account, the company gets a percentage of the transaction that can vary from a single payment (Cost per Acquisition also known as CPA) to recurring revenues depending on cardholder’s activity.

Contrary to the personal affiliate credit cards Business credit card programs are targeted at a particular group of people such as freelancers, entrepreneurs, small-scale business owners, and corporate customers. They usually have specific advantages, like more credit limits, expenses monitoring tools, employees cards and rewards programs that are designed to help with business expenses such as office equipment, travel and advertising. There is a growing need for this type of financial tool, along with the lucrative commissions that are offered make this market attractive to affiliate marketers.

Why Choose Business Credit Card Affiliate Programs?

The business credit card market provides a number of compelling advantages to affiliate marketers:

- High Commissions Credit card affiliates for business programs typically pay large commissions, that range from $2 up to 200 or even more for an accepted application. Some programs also have revenue-sharing plans, which offer regular income that is based on spending.

- Recurring Revenue Opportunities: Some programs allow recurring commissions so long as the cardholder continues to be active, thereby creating an income stream that is passive. This is especially appealing to affiliates seeking to generate long-term income.

- Strong Demand Strong Demand U.S. credit card industry has generated more than $180 billion of issued revenue in 2023 while the market for corporate credit cards is expected to increase as more small companies seek out financial instruments to manage the flow of cash and expenditures.

- Diverse Audience: Business credit cards are available to a variety of professionals, ranging from individuals who work as freelancers and corporate managers. Affiliates can use their credit cards to target different niches such as startups, e-commerce or travel-related companies.

- Trusted Brands: partnering with trusted financial institutions such as American Express, Chase, or Capital One enhances your credibility and boosts the conversion rate.

- Marketing Support: A lot of programs offer affiliates marketing materials, tracking tools and dedicated support for optimizing campaigns and make it easier for affiliates to be successful.

Top Business Credit Card Affiliate Programs for 2025

Here’s a comprehensive list of top affiliate programs for business credit cards in 2025 based on their commission structure, brand recognition and affiliate support. Every program is analyzed to determine its potential for earning and its suitability to different types of customers.

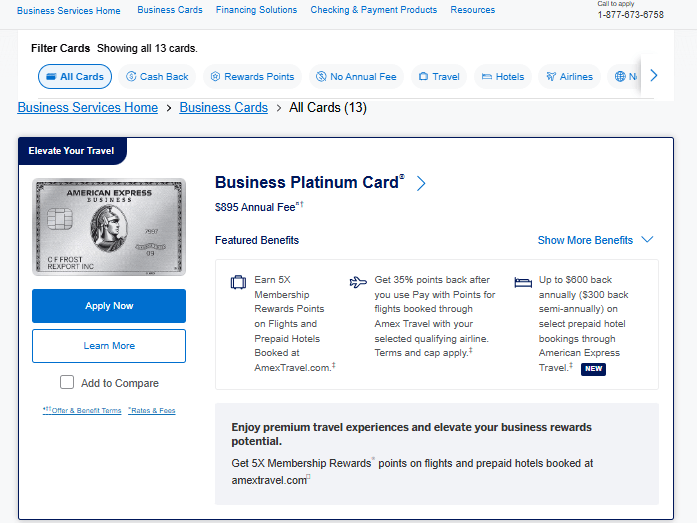

1. American Express Affiliate Program

Commission Maximum: $200 per applicant who is approved (varies depending on the area, e.g., CA$200 in Canada).

Time for Cookies: 7 to 30 days, based on the provider.

Network: Managed by platforms such as CJ Affiliate, Awin, or Bankrate.

Why Join? : American Express is a internationally renowned brand offering many business credit cards, such as The Business Platinum Card(r) and Business Gold Card(r). Affiliates can benefit from the highest commissions, a trusted brand and access to promotional materials such as ads and pages for landing. This program is perfect for financial-focused business owners and corporate customers.

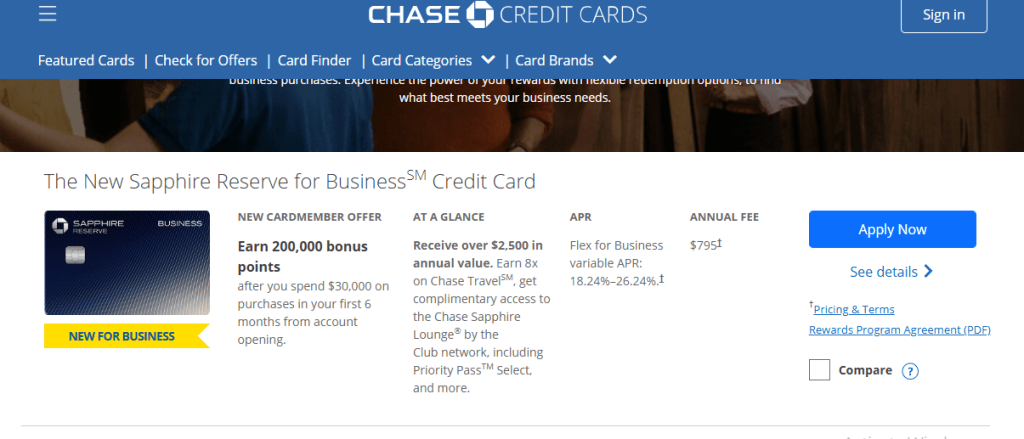

2. Chase Affiliate Program

Commission Rates vary by product With higher rates for credit cards for businesses (up to $100-$200 per approved).

Cookie Duration: 30 days.

Network: Managed by CJ Affiliate.

Why Join? : Chase offers a variety of business credit cards including The Ink Business Preferred(r) Credit Card that is a great choice for small-sized business owners who want to earn incentives for travel as well as advertising. The card offers live tracking in real time and extensive marketing tools that make it a great choice for affiliates that target business customers.

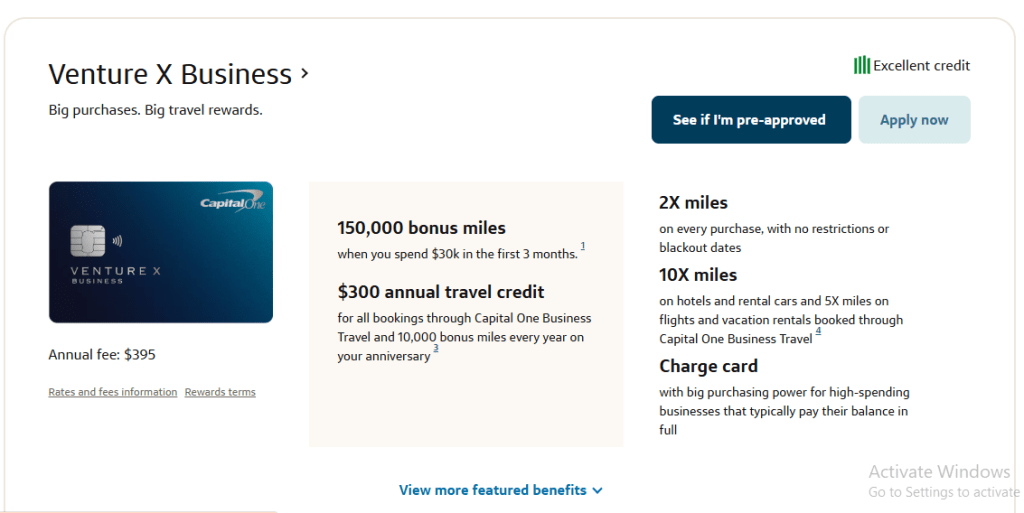

3. Capital One Associates

Commission $100 per accepted credit card for business, with a maximum annual limit at $500 in referral program.

Cookie Duration: 30 days.

Network: Managed via FlexOffers as well as other network.

Why Join? Capital One’s credit cards, including those offered by the Capital One Spark Cash for Business, are well-known due to their cashback rewards as well as no-annual-fee options. The program is easy to use and provides a straightforward commission structure that is ideal for affiliates that target small companies as well as startups.

4. Bankrate Credit Card Network

Commission: varies, usually $50-$200 per signup depending on the issuer of the card.

Cookie Duration: Unknown however, it is usually 30 days.

Network: Bankrate’s own network.

Why Join? : Bankrate operates as both an affiliate and network, providing access to the major card issuers, including Chase, Discover, and American Express. Affiliates can benefit from sophisticated tracking tools, co-branding solutions, as well as the ability to access Bankrate’s award-winning content that boosts trust and increases conversions.

5. USAA Affiliate Program

- Commission Maximum: $80 per application that is completed.

- Cookie Duration: 30 days.

- Network: Managed by CJ Affiliate.

- Why Join? : USAA specializes in financial products for families of military personnel and small-scale business owners, providing an unique opportunity for affiliates that cater to military-related audience. The program offers exclusive promotional materials as well as high-converting content, however its appeal isn’t as wide beyond the military community.

6. Capital Bank (OpenSky(r) Secured Visa(r) Credit Card)

- Commission $25 for each confirmed and credited account.

- Cookie Duration: 30 days.

- Network: Managed by CJ Affiliate.

- Why Join? This OpenSky Secured Visa is ideal for companies that do not have requirement for credit checks, and appeals to entrepreneurs who have low or no credit background. Its simple commission structure as well as the ability to convert well makes it an ideal option to add to your affiliate portfolios.

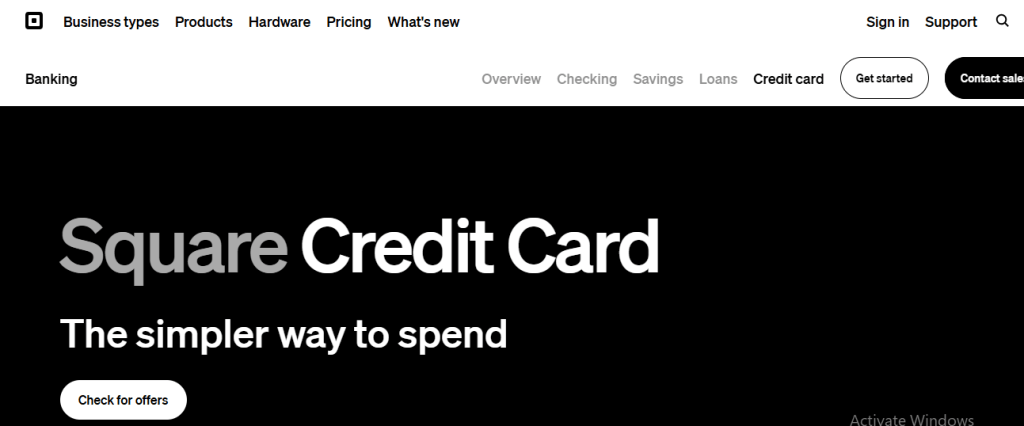

7. Square Affiliate Program

- Commission Variable, usually built on the Cost Per Sale (CPS) model that has a minimum of $100 amount to be paid.

- Cookie Duration: 30 days.Network: Managed by Tapfiliate.

- Why Join? : Square offers payment solutions and business credit cards designed to small-sized businesses. Affiliates are able to promote a variety of products, such as payroll systems and POS which makes it a flexible software for tech and finance-oriented creators.

8. Chime Affiliate Program

- Commission 10 10% of Monthly Recurring Income (MRR) up to 18 month per referrer.

- Cookie Duration: Vary (1 one day for CJ Affiliate more than with other platforms).

- Network: Managed by Tapfiliate, FlexOffers, and CJ Affiliate.

- Why Join? Chime’s secure credit card and banking solutions appeal to businesses that are cost conscious. The commission structure that recurrs over time is a big attraction for affiliates looking to earn an income stream that lasts for a long time.

Key Considerations When Choosing a Program

The most important things to consider when selecting an Affiliate Program Before registering with an affiliate credit card for business program, you should consider the following aspects:

- Commission Structure: Seek companies that offer high CPA or model of recurring revenue. Compare rates across networks to make sure you’re getting the most value for your money.

- Brand Reputation: Work with trusted issuers such as American Express or Chase to improve credibility and increase conversions.

- The duration of the cookie: Longer durations (e.g. 30 days) allow you to have an opportunity to make commissions more frequently from referral users.

- Audience Alignment: Make sure the features of the card meet your customers’ needs. For instance, USAA is ideal for people who are interested in military, whereas Square is a popular choice for entrepreneurs with a tech background.

- Marketing Support: Select applications that include powerful tools, like banners or landing pages, as well as specific account management.

- Payout Terms: Check minimum payout thresholds, payment frequency, and methods (e.g., PayPal, direct deposit)

Challenges and How to Overcome Them

The frequency of payment and payment ways to pay (e.g., PayPal, direct deposit).

Problems and Strategies to Surmount Them affiliate programs for business credit cards are profitable, they do are not without challenges:

A Niche of Competition: The finance sector is extremely competitive, with well-established players such as Nerdwallet as well as Credit Karma dominating. In order to stand out from the crowd, concentrate on a particular sub-niche like cards for freelancers or new businesses.

The strictest Approval Processes Certain program require associates to hold an account or a card from the service provider. Make sure you have a professional site or blog to boost the chances of being approved.

Consumer trust Financial products are delicate. To combat this, provide clear, valuable content and working with trusted brands.

- Compliance: Observe specific terms of the program, for example SEM guidelines and restrictions on marketing in order to avoid suspension of your account. Bankrate, for instance, has a compliance team to ensure that affiliates are in compliance with expectations.

Why Vellko Media Is a Top Choice for Business Credit Card Affiliate Programs

Vellko Media, a Bhopal-based performance marketing company established in 2021, has grown into an established partner for affiliates working in the financial sector particularly for credit card business affiliate programs.

1. Finance-Focused Expertise

Vellko is a specialist in high-value financial industries such as the credit and loans industry and insurance. They excel at targeting business owners, entrepreneurs, and freelancers through SEO, social ads, email, and SMS campaigns–delivering high-intent, high-conversion leads. Their compliance team makes sure that they adhere of FTC as well as GDPR as well as issuer guidelines which reduces risk for affiliates.

2. Affiliate-Friendly Tools & Support

Affiliates have access to affiliates get a easy-to-use dashboard and lead verification using AI and specific account manager to assist with strategy. Vellko offers banners, tracking hyperlinks, and comparison content that is ready to use for credit card promotion.

3. High Payouts & Flexible Models

Commissions vary between 50 to 500 dollars for approved applications With CPL, CPS, and PPC payment options. Payouts are fast and reliable through PayPal as well as bank transfers or wire, with a lower $100 limit.

4. Global Reach & Scalability

Vellko is able to accept traffic coming from the top markets such as that of the U.S., Canada, and UK. They will support campaigns that range that range from small blogs to multi-channel pay-per-click ads, making the ideal choice for both novice as well as experienced affiliates.

5. Trusted Reputation

With a solid reputation from Trustpilot and AffPaying and relationships with reputable payment processors Vellko offers high-converting deals and secure payment options.

The bottom line: Vellko Media offers niche financial expertise with strong compliance, large payouts, and a hands-on service that makes it the ideal option for affiliates who promote corporate credit card.

5. Access to Multi-Geo Campaigns

Run global campaigns in:

Conclusion

FAQ: Vellko Media and Business Credit Card Affiliate Programs

1. What is Vellko Media, and how does it support business credit card affiliate programs?

Vellko Media is a Bhopal-based performance marketing and lead generation firm that specializes in financial verticals such as credit cards. It connects affiliates to high-paying business credit card deals from issuers such as American Express, Chase, and Capital One, providing tools such as real-time tracking, AI-powered lead match as well as marketing materials (banners and links, and banners) to increase conversions. Their focus on compliance makes sure that campaigns comply with financial regulations

2. What commissions can I earn with Vellko’s business credit card affiliate programs?

Commissions can are between $50 and $200 per application that is approved depending on the issuer and card. Vellko provides Cost-Per-Lead (CPL) Cost-Per-Sale (CPS) as well as Pay-Per-Click (PPC) options, as well as certain programs that offer recurring income for cardholders who are active. The exact rates differ by deal, and are accessible through Vellko’s dashboard as well as partner networks such as CJ Affiliate

3. Do I need a website to promote business credit cards with Vellko?

While websites boost the credibility of a business, Vellko permits affiliates to advertise offers on email, social media or SMS messages, as well as paid advertisements. They offer content such as reviews or comparison guides to help affiliates reach out to businesses on platforms such as LinkedIn as well as Instagram

4. How does Vellko ensure high-quality leads for business credit card campaigns?

Vellko utilizes AI-driven tools to provide real-time lead matching as well as fraud detection, which ensures that leads are of high-intent and authentic. Their strategies that are targeted (e.g. Social media, SEO advertisements) target entrepreneurs and small-scale business owners, boosting the approval rate for cards such as those offered by the Chase Ink Preferred(r

5. Is Vellko beginner-friendly for affiliate marketers?

Absolutely, Vellko is ideal for novices, with a simple dashboard, account managers who are dedicated and educational tools. Reviewers on AffPaying are positive about their assistance for affiliates who are new, but understanding financial compliance might need some learning

6. What are the payout terms with Vellko?

Vellko provides timely payments through PayPal or bank transfer or wire transfer, with a minimum threshold for payout of $100. Affiliates can anticipate monthly or weekly payouts dependent on the type of campaign, as described by AffPaying reviews

7. How does Vellko ensure compliance in financial affiliate marketing?

Vellko’s compliance department ensures that campaigns are compliant with the regulations of GDPR CCPA as well as FTC guidelines. They scrutinize the promotional materials and lead generation techniques to avoid problems, ensuring that it is safe to advertise credit cards from reputable issuers

8. Can I promote business credit cards globally with Vellko?

The answer is yes, Vellko will accept traffic coming from countries with high payouts like that of the U.S., Canada, and the UK which is ideal for credit card marketing campaigns for businesses. Their global presence, which is evident at events such as Affiliate World Summit provides the ability to access a range of offers

9. What types of business credit cards can I promote through Vellko?

Vellko collaborates with various networks that offer cards in a variety of areas, such as reward cards (e.g., American Express Business Platinum), cashback cards (e.g., Capital One Spark Cash) and even no-credit-check options (e.g., OpenSky(r) Secured Visa). Affiliates may target freelancers, startups or corporate clients

10. How do I join Vellko’s affiliate program?

Visit vellko.com to sign up, or reach out to their customer service team to gain login to the affiliate portal. You can also sign up through partner networks such as CJ Affiliate or FlexOffers, which is where Vellko provides its offers. Approval might require a basic application and proof of knowledge

Suggested

- 5 Best Insurance Affiliate Programs 2025 You Must Know

- Top Paying Supplements Affiliate Programs

- Credit Card Affiliate Program

- How to Track Affiliate Sales

- 16 Best Fashion Affiliate Programs in 2025

- CPM vs RPM

- Best Spy Tools for Affiliate Marketing

- The Most Profitable Blog Niches in Affiliate Marketing 2025

- Top 3 Real Estate Affiliate Programs in 2025

- Ecommerce Affiliate Programs: A Step Ahead to Grow in 2025

- 7 Channels to Promote your Affiliate Links in 2025

- Top 5 Push Notifications Traffic Networks in 2025

- #1 Find the Best Debt Settlement Leads to Grow Your Business!

- Boost Your Sales: How To Get Personal Loan Leads In 2025

- Luxury Affiliate Programs

- Best Skincare Affiliate Programs to Promote in 2025

- Mortgage Loan Affiliate Program

- Affiliate Program for Dietary Supplements

- Personal Finance Affiliate Programs

- Financial Affiliate Programs

- Investing Affiliate Programs

- Business Loan Affiliate Programs

- Payday Loan Affiliate Programs

- Top Banking Affiliate Programs

- Mortgage Loan Affiliate Program

- Personal Loan Affiliate Program